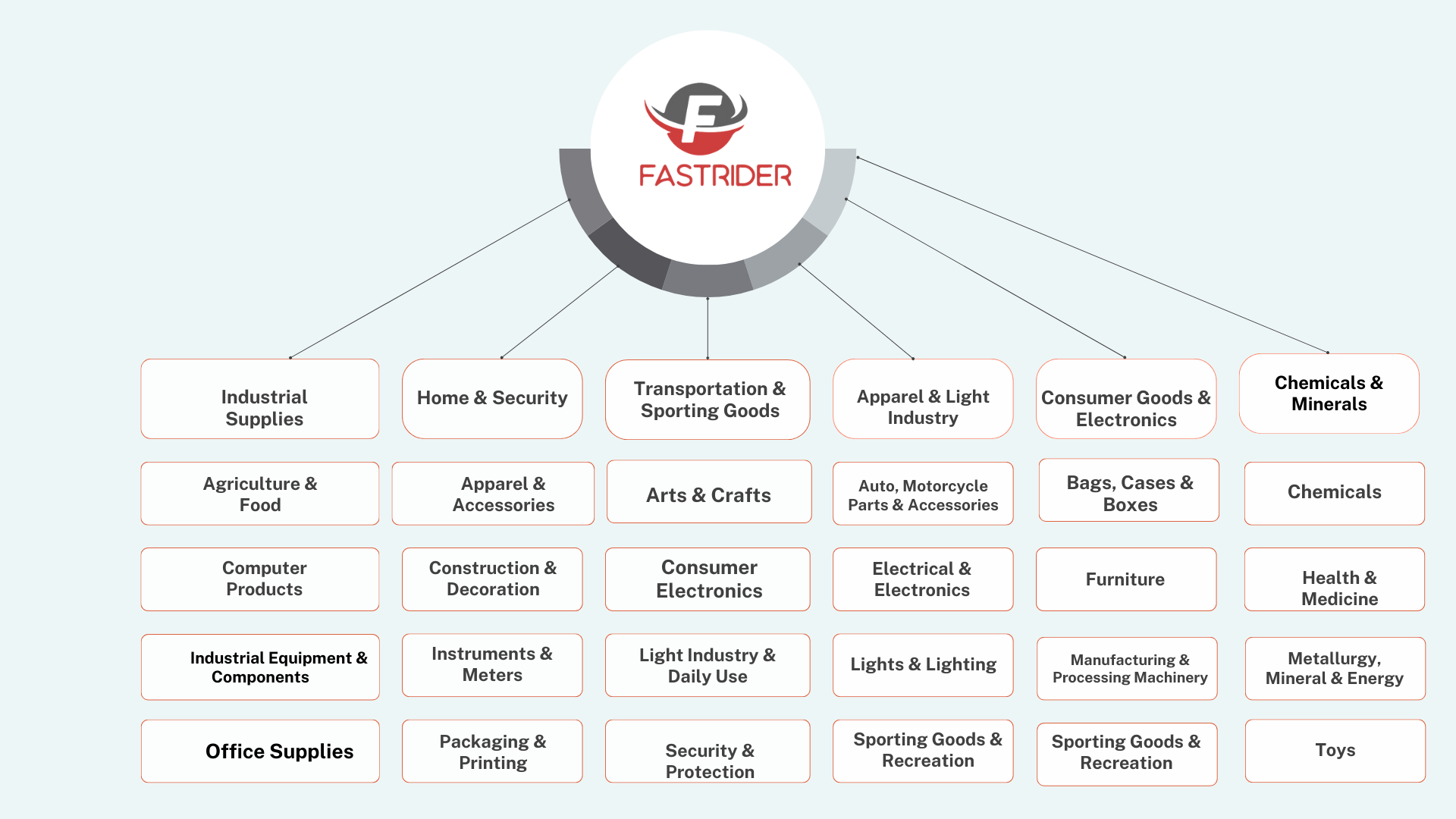

The One Stop Solution

B2B Services

Fastrider Exim Management for Merchant Exporters is designed to streamline and optimize the entire export process for Indian merchants, ensuring a seamless experience in international trade. Fastrider provides a comprehensive set of services tailored to the needs of exporters, helping them reach global markets efficiently and securely. Here's how Fastrider supports merchant exporters

Supplier and Buyer Matching

Global Marketplace: Fastrider connects Indian exporters with international buyers through a digital platform, offering visibility to a global audience

End-to-End Export Documentation

Customs and Regulatory Compliance: Fastrider ensures that all export documentation, including invoices, certificates of origin, and shipping bills, is compliant with international trade regulations

Logistics and Shipping Management

Fastrider optimizes shipping routes across sea, air, and land, depending on cost, time, and cargo type, ensuring the best service for merchants.

Payment Solutions and Risk Management

Secure Payment Gateways: Fastrider offers multiple payment options, such as letters of credit (LC), escrow services, and secure bank transfers, to protect both exporters and buyers from fraud or payment issues

Regulatory Compliance and Risk Mitigation

Export License Management: Fastrider ensures that exporters comply with export control laws, handling export licenses, tariffs, and quotas.

Quality Control and Inspection Services

Pre-shipment Inspections: Fastrider facilitates inspections of goods before they are shipped, ensuring product quality meets buyer specifications and international standards

Sustainability and Ethical Sourcing

Environmentally Responsible Practices: Fastrider encourages exporters to adopt sustainable practices, ensuring that goods are produced and transported in an environmentally responsible manner

Market Insights and Analytics

Global Market Trends: Fastrider offers insights into global market trends, helping Indian merchants identify high-demand markets and adjust their export strategies

Customs and Tariff Management

Duty and Tax Management: Fastrider provides detailed information on international tariffs, taxes, and duties for each export destination, ensuring exporters are aware of and can plan for all costs

Post-Shipment Services

Customs Clearance Assistance: Fastrider assists in managing customs procedures in both India and the destination country, ensuring that the goods are cleared without delays or complications..

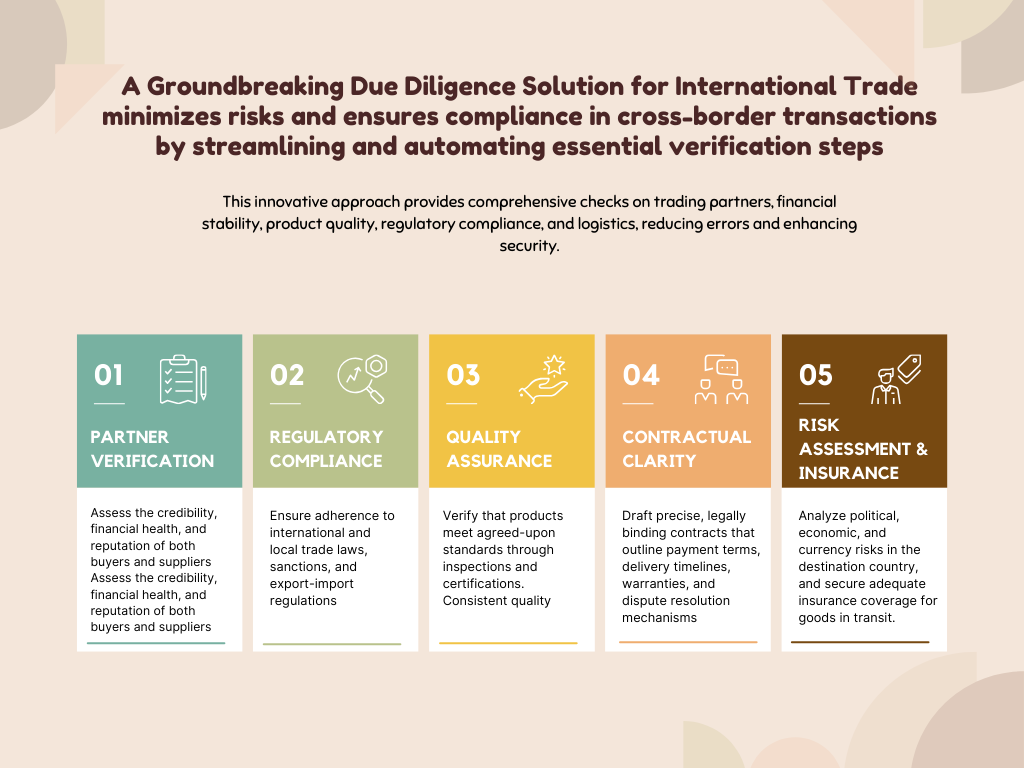

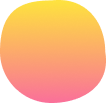

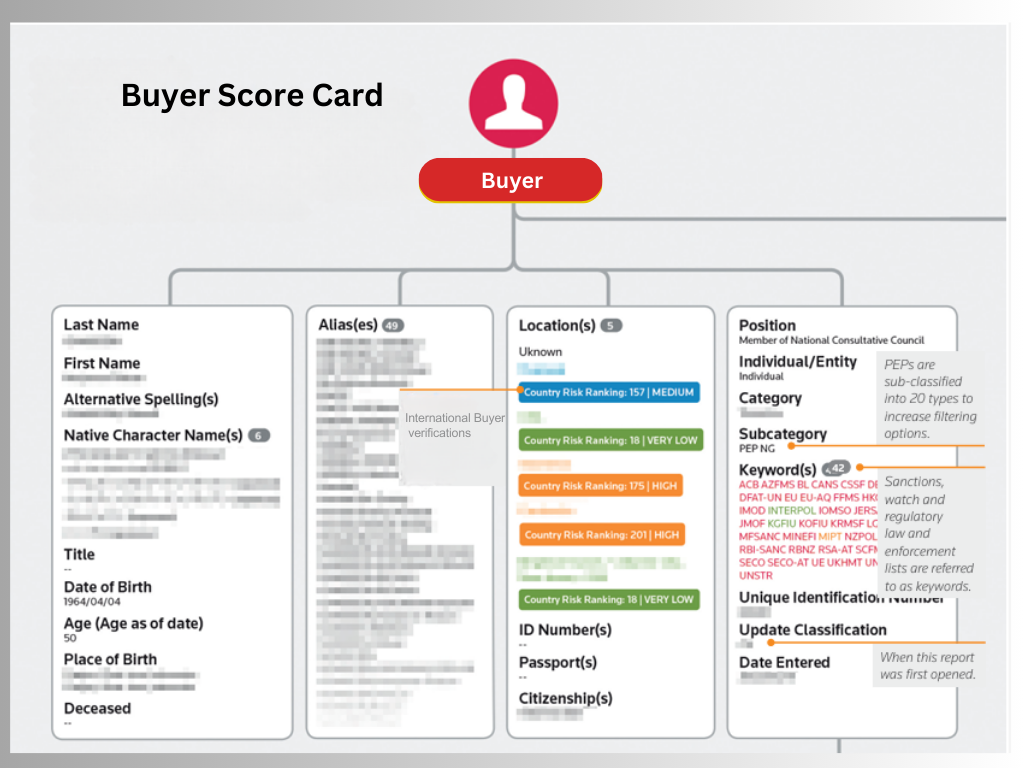

Due Diligence on Buyers and Partners

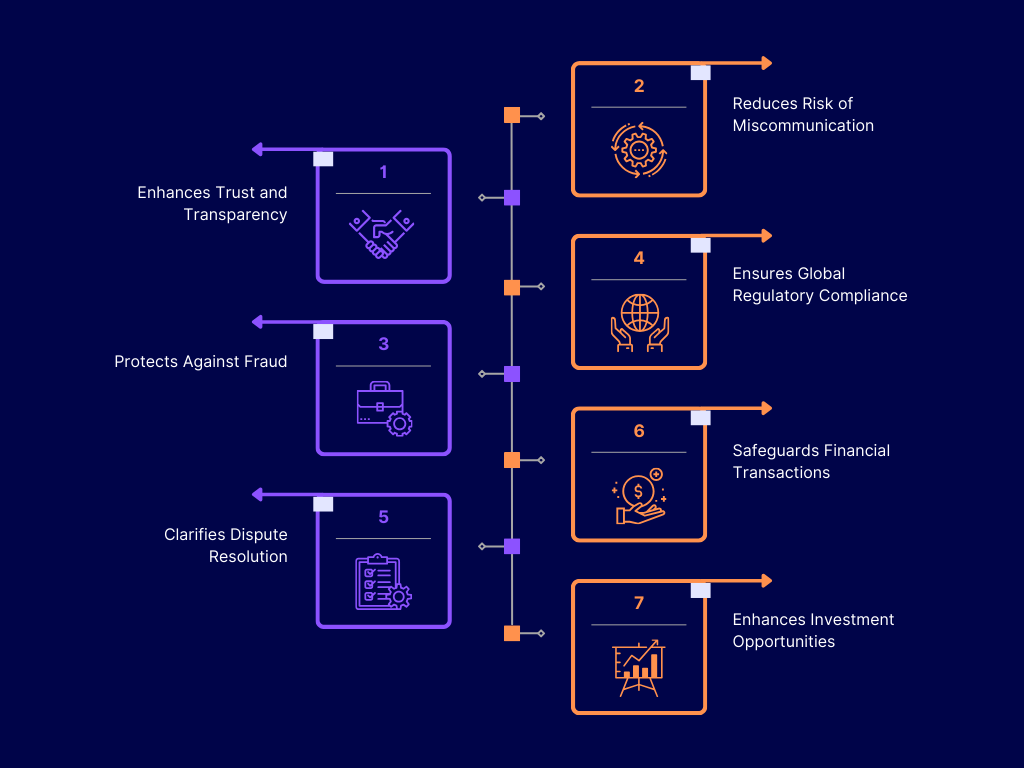

Due diligence on buyers and partners is essential for ensuring trustworthy and secure trade relationships. By verifying the credibility and financial health of buyers and partners, exporters can reduce the risks of fraud, non-payment, and non-compliance, creating a stable foundation for international trade. This process involves a comprehensive assessment of a buyer’s or partner’s background, financial status, business practices, and compliance with local and international regulations.

Accurate and Comprehensive Documentation

Accurate and Comprehensive Documentation is essential for merchant exporters to ensure smooth international transactions. This includes securing all necessary export licenses, accurately completing invoices, and adhering to the specific documentation standards of the importing country, such as certifications, product descriptions, and HS codes. Proper documentation minimizes customs delays, reduces compliance risks, and ensures clarity in transactions, helping exporters maintain a seamless supply chain and uphold their reputation in the global market

- Accurate Documentatio

- Quality Compliance and Certifications

- Customs and Tariff Knowledge

- Payment Terms and Methods

- Insurance Coverage

- Export Licenses and Permits

- Incoterms Compliance

- Supplier and Buyer Verification

Secure Payment Terms

Secure payment terms are vital for merchant exporters to ensure timely and complete payment, minimizing the risk of financial losses from international trade. By structuring payment terms carefully, exporters can protect against non-payment and improve cash flow stability, fostering trust between them and foreign buyers.

Know About Us- Payment Method Selection

- Incoterms Agreement

- Advance Payments

- Credit Terms and Limits

- Currency Risk Management

- Payment Due Dates

- Invoice and Documentation Accuracy

- Payment Tracking Systems

- Escrow Accounts for High-Value Transactions

- Risk Mitigation Instruments

Risk Management and Insurance

Risk management and insurance are critical components for merchant exporters to safeguard against potential losses arising from unforeseen events in international trade. Effective risk management practices, combined with appropriate insurance policies, can protect exporters from financial hardships due to shipment delays, currency fluctuations, non-payment, and political instability.

- Trade Credit Insurance

- Marine and Cargo Insurance

- Political Risk Insurance

- Contractual Risk Assessment

- Currency Hedging

- Product Liability Insurance

- Pre-Shipment and Post-Shipment Financing

- Compliance with International Trade Laws

- Claims and Dispute Management

Quality Control and Product Verification

Quality control and product verification are essential steps for merchant exporters to ensure that goods meet the standards and specifications agreed upon with international buyers. By implementing robust quality assurance practices, exporters can enhance customer satisfaction, reduce the risk of returns, and build a reputable brand image in global markets..

- Pre-Production Inspections

- In-Process Quality Control

- Final Product Inspection

- Lab Testing and Certification

- Supplier Verification and Audits

- Quality Documentation and Traceability

- Compliance with International Standards

- Packaging and Labeling Verification

- After-Sales Quality Support

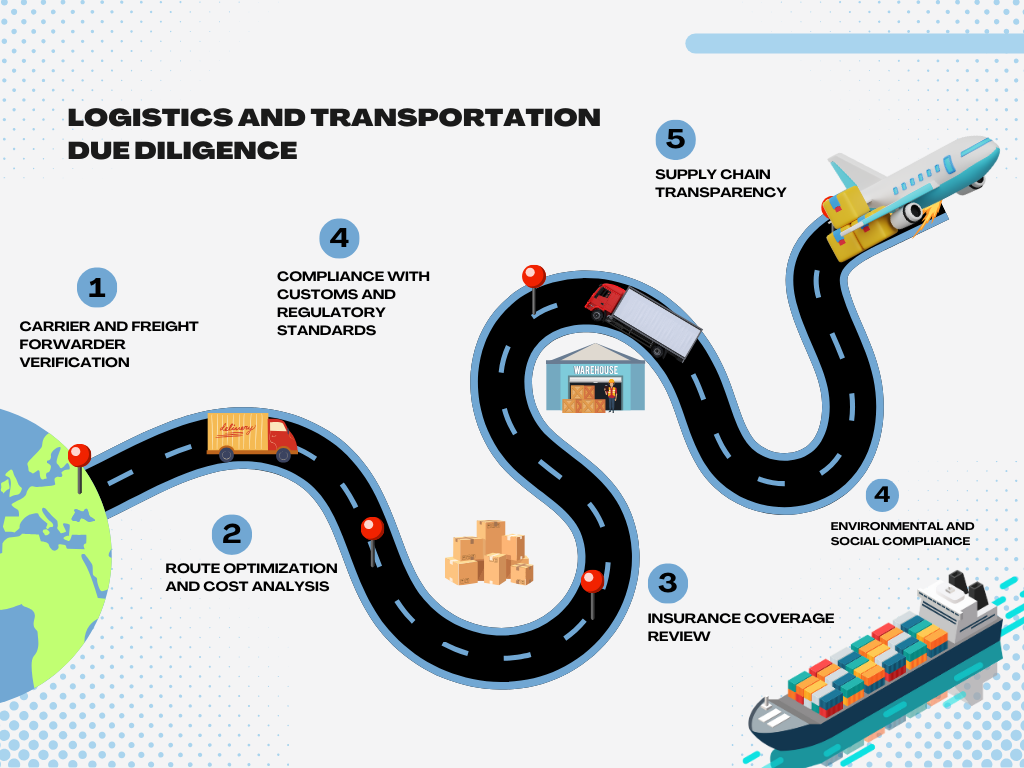

Logistics and Transportation Due Diligence

Logistics and transportation due diligence is crucial for merchant exporters to ensure the safe, timely, and efficient movement of goods from the point of origin to the buyer's destination. It helps mitigate risks associated with delays, damages, or unexpected costs, supporting a smooth trade process and enhancing customer satisfaction

- Carrier Selection

- Route Optimization

- Customs and Compliance Checks

- Insurance Coverage

- Packaging and Labeling Standards

- Documentation Accuracy

- Freight Forwarder Selection

- Inventory and Tracking

- Warehouse and Storage Facilities

- Cost Management

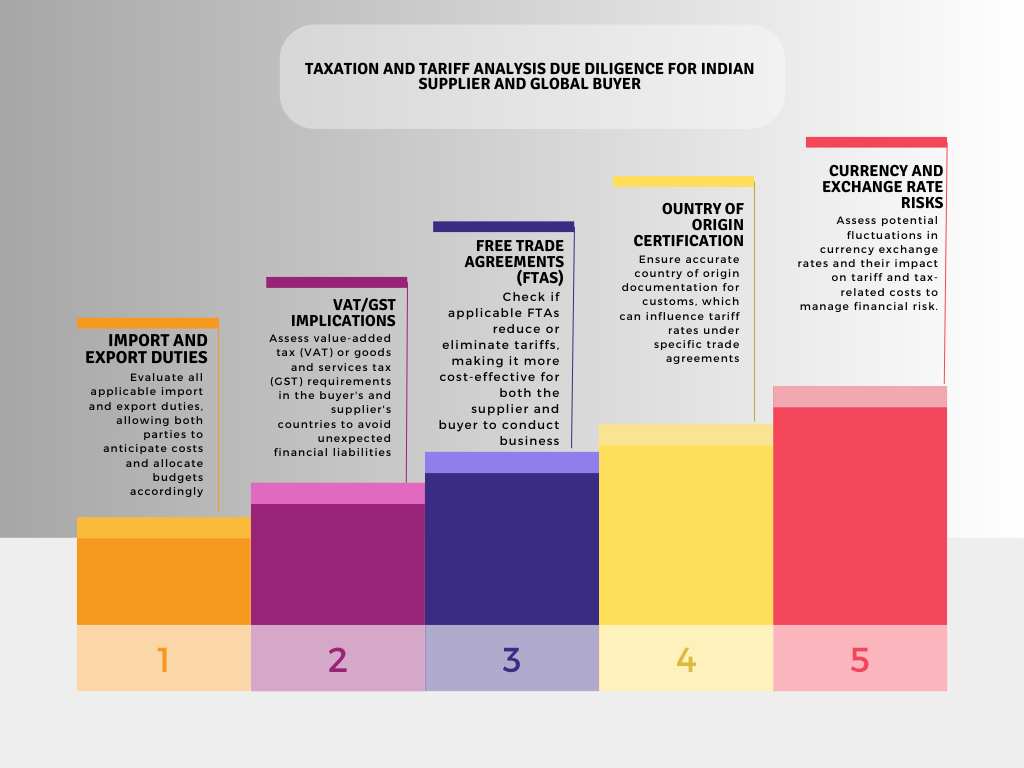

Taxation and Tariff Analysis

Taxation and tariff analysis is a critical component of international trade for merchant exporters, as it affects pricing, competitiveness, and profitability. Merchant exporters must understand tax obligations and tariff structures in both their home and target markets to avoid unexpected costs, ensure compliance, and optimize their pricing strategies.

- Import and Export Duties

- Preferential Trade Agreements

- VAT and GST Requirements

- Harmonized System (HS) Codes

- Customs Clearance Fees

- Country of Origin Rules

- Currency Exchange Rates and Taxes

- Local Tax Regulations

- Transfer Pricing Rules

- Anti-Dumping and Countervailing Duties

- Excise Duties on Specific Goods

- Freight and Insurance Cost Allocation

Environmental and Social Due Diligence

Environmental and social due diligence is essential for merchant exporters aiming to align with international sustainability standards, protect their brand reputation, and meet the expectations of global buyers. This type of due diligence helps identify and mitigate environmental impacts, uphold human rights, and ensure ethical practices throughout the supply chain.

- Environmental Impact Assessments

- Sustainable Resource Sourcing

- Regulatory Compliance

- Human Rights and Labor Standards

- Waste Management and Recycling

- Health and Safety Standards

- Supplier Environmental Certifications

- Energy Efficiency

- Community Engagement

Sanctions and Embargo Checks

Sanctions and embargo checks are critical for merchant exporters to ensure compliance with international laws and to avoid severe penalties, reputational damage, or disrupted trade operations. By implementing thorough checks on sanctions and embargoes, exporters can mitigate risks associated with trading with restricted or banned entities, countries, or individuals.

- Country-Specific Sanctions

- Restricted Party Screening

- Dual-Use Goods Assessment

- Screening Against Export Control Lists

- End-Use Verification

- Real-Time Sanction Updates

- In-House Compliance Policy

- Export Licensing Requirements

Opportunities in the Buyer Market for Merchant Exporters

Merchant exporters have significant growth potential in the international buyer market, with evolving trade dynamics and increasing global demand for diverse products. Identifying the right opportunities can lead to increased sales, long-term partnerships, and expanded market reach.

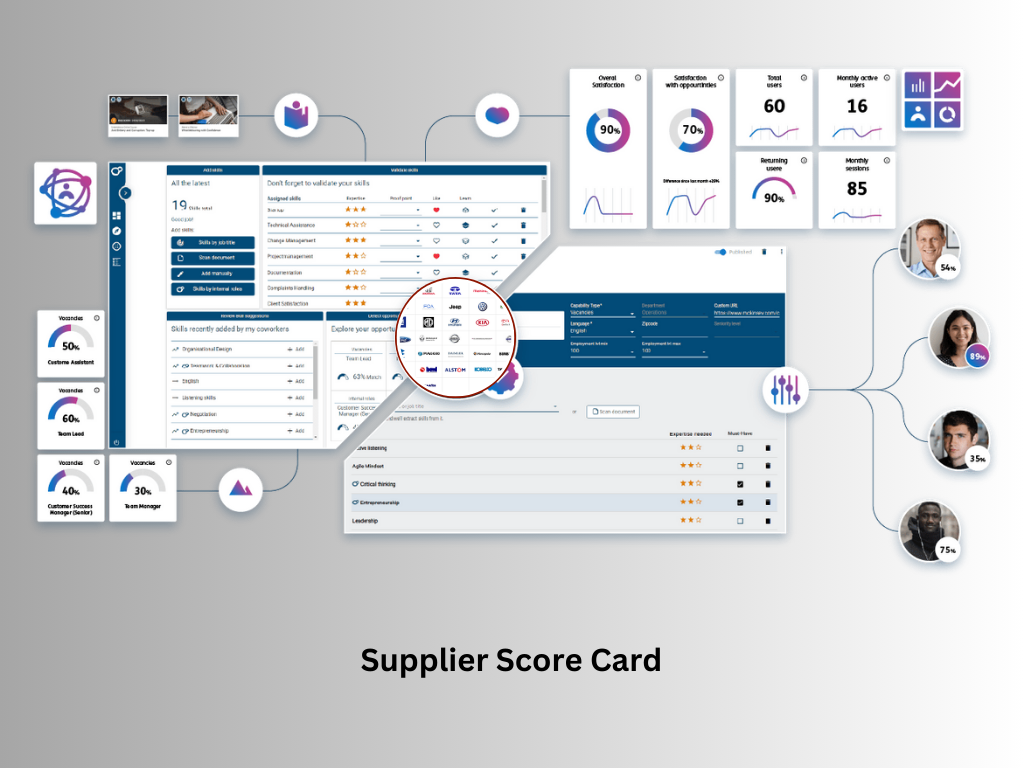

Opportunities in the Supplier Market for Merchant Exporters

The supplier market offers unique advantages for merchant exporters, as it provides access to a variety of products, competitive sourcing options, and the ability to scale efficiently to meet international demand. Strategic engagement with suppliers is essential to unlock growth, maintain quality, and optimize costs.

Supported By